kasin0123.site Categories

Categories

Strategy Of Financial Management

Finance strategy requires a balance of financial planning and strategic planning. The finance strategy should assess current resources, costs and budget; define. It helps you develop a vision for your company's success and becomes a set of controlling principles under which the company operates. A financial strategy is a. Strategic financial management goes beyond financial planning, budgeting, managing financial resources, controlling spend and liabilities, and mitigating risk. 2Leading and managing the departmental financial management function, including the following: Providing strategic financial and business advice to. It covers strategies of growth, mergers and acquisitions, financial performance analysis over the past decade, wealth created in terms of stock returns. Strategic finance works on many things, including optimizing the business, makes ROI determinations for future projects, and sizes the impact of. Foster an FM community of practice: Provide forums, tools, and experiences that promote information- sharing, networking, mentoring, and collaboration. Measuring investment and strategic performance: Master Balance Sheet insights, optimise Income Statement analysis and gauge customer value. Management choices. Strategic financial management is a term used to describe the process of managing the finances of a company to meet its strategic goals. Finance strategy requires a balance of financial planning and strategic planning. The finance strategy should assess current resources, costs and budget; define. It helps you develop a vision for your company's success and becomes a set of controlling principles under which the company operates. A financial strategy is a. Strategic financial management goes beyond financial planning, budgeting, managing financial resources, controlling spend and liabilities, and mitigating risk. 2Leading and managing the departmental financial management function, including the following: Providing strategic financial and business advice to. It covers strategies of growth, mergers and acquisitions, financial performance analysis over the past decade, wealth created in terms of stock returns. Strategic finance works on many things, including optimizing the business, makes ROI determinations for future projects, and sizes the impact of. Foster an FM community of practice: Provide forums, tools, and experiences that promote information- sharing, networking, mentoring, and collaboration. Measuring investment and strategic performance: Master Balance Sheet insights, optimise Income Statement analysis and gauge customer value. Management choices. Strategic financial management is a term used to describe the process of managing the finances of a company to meet its strategic goals.

The strategies for financial planning involve a systematic process of setting goals, evaluating resources, and outlining the steps needed to achieve those. Financial strategy is how a company plans to reach its short- and long-term goals. A company's financial strategy contains three major components: financing. Investors maximize their wealth by. © The Institute of Chartered Accountants of India. Page 2. Strategic Financial Management selecting optimum investment. Strategic financial management refers to the study and application of principles, concepts, and techniques that guide an organization to create value and. What is strategic financial management? Strategic financial management is the process of managing the finances of a company to meet the organisation's goals. 1. Setting financial goals · 2. Net worth statement · 3. Budget and cash flow planning · 4. Debt management plan · 5. Retirement plan · 6. Emergency funds · 7. Strategic financial planning is the process of determining how a business manages itself financially to ensure it achieves its goals and objectives for both. Building on key insights from stakeholders, business leaders, and market dynamics, a finance strategy includes focus areas, objectives, initiatives, and KPIs. 8 Strategies For Financial Success · 1. Develop a Budget · 2. Build an Emergency Fund · 3. Stretch Your Dollars · 4. Differentiate between Good Debt and Bad Debt · 5. Finance professionals need to continuously upskill and reskill to stay on top of the latest terminology, technology, and trends. Our ten-month Professional. The Department of Defense (DoD) Financial Management (FM) Strategy is the first-of-its-kind, Department-wide strategy to help prioritize the DoD FM. Enhanced Decision-Making: A clear financial strategy provides a roadmap for decision-making related to budgeting, investments, cost control. Strategy Development: With clear goals and an understanding of available resources and risks, developing a strategic financial plan is the next step. This. Ten top tips to improve your financial management · 1. Have a clear business plan · 2. Monitor your financial position · 3. Ensure customers pay you on time · 4. Financial strategy is how a company plans to reach its short- and long-term goals. A company's financial strategy contains three major components: financing. Finance theory assumes that a project will be evaluated against its base case, that is, what will happen if the project is not carried out. Managers tend to. Therefore, Strategic Financial Management are those aspect of the overall plan of the organisation that concerns financial management. This includes different. What is strategic financial management? Strategic financial management creates and manages a company's financial strategy aligned with its business objectives. Financial planning is the process of assessing the current financial situation of a business to identify future financial goals and how to achieve them. The.

Work Under The Table Jobs

“Working under the table” typically refers to the practice of paying employees in cash/being paid in cash for the explicit purpose of avoiding taxes or other. Home Department Human Resources Employment Information & Job Opportunities Salary Grade Table. KB • pdf • September 9, get_app; pdf icon. Typing. Under the Table Pay jobs available on kasin0123.site Apply to Server, Porter, Production Worker and more! Click to select the table applicable to the supplemental question. Once completed, add/attach the table to the “Applicant Documents” section of the job. “People kept saying, 'As soon as I figured out what to do with my dining room table, then I was free to move,'” reports Moesta. What work-arounds have people. employment history/job-related knowledge, qualifications Yes, Corner Table Restaurants can contact me directly about specific future job opportunities. If you want to work under the table or unreported you should figure out something you're good at and advertise on Craigslist to do it. Find Cash Under The Table jobs in South Carolina. Search for full time or part time employment opportunities on Jobs2Careers. Under the Table Pay jobs available in New Jersey on kasin0123.site Apply to Server, Host/hostess, Pet Groomer and more! “Working under the table” typically refers to the practice of paying employees in cash/being paid in cash for the explicit purpose of avoiding taxes or other. Home Department Human Resources Employment Information & Job Opportunities Salary Grade Table. KB • pdf • September 9, get_app; pdf icon. Typing. Under the Table Pay jobs available on kasin0123.site Apply to Server, Porter, Production Worker and more! Click to select the table applicable to the supplemental question. Once completed, add/attach the table to the “Applicant Documents” section of the job. “People kept saying, 'As soon as I figured out what to do with my dining room table, then I was free to move,'” reports Moesta. What work-arounds have people. employment history/job-related knowledge, qualifications Yes, Corner Table Restaurants can contact me directly about specific future job opportunities. If you want to work under the table or unreported you should figure out something you're good at and advertise on Craigslist to do it. Find Cash Under The Table jobs in South Carolina. Search for full time or part time employment opportunities on Jobs2Careers. Under the Table Pay jobs available in New Jersey on kasin0123.site Apply to Server, Host/hostess, Pet Groomer and more!

We're willing to train someone with a positive attitude & determined work ethic! We look forward to hearing from you. Apply Now. Restaurant Host - City Table. Under the table jobs can encompass a wide range of informal, cash-based employment. These can include tasks like lawn mowing, gardening, house or office. Job Service Centers can provide resources to assist you in Career Exploration, Job Searches, a New Career, and Training. See what resources and events are going. 72 under the table jobs available in winnipeg, manitoba. See salaries, compare reviews, easily apply, and get hired. New under the table careers in winnipeg. OUR COMPANY NEED MORE STAFF (8People) Anyone willing to work a Morning shift 9am-2pm Evening shift 4pmpm Good Salary -Part time: $ / Per Day -Full Time. Ensuring that we have the best people for the job doesn't stop at recruitment. As part of coming on board, we want to ensure that you have the right knowledge. You shouldn't include income from any jobs or self-employment. If you job, find the amount from the appropriate table on page 4. Using the “Higher. Table Server · Immediate start. Shift work · Half Smoke ; Urgent Care position under an hour north of Tampa Florida · Holiday work. Permanent employment. Relocation. job market through work experience and job training programs. kasin0123.site This program helps under-served and under-employed populations in Los. The number of permanent job losers was essentially unchanged at million in August. (See table A) The number of long-term unemployed (those jobless for. Cash Applications Specialist · Cash in hand. Holiday work. Full time · ENA Corporate ; Cash Control Specialist (On-site) · Holiday work. Flexible hours · Shellpoint. 86 cash under the table jobs available in florida. See salaries, compare reviews, easily apply, and get hired. New cash under the table careers in florida. 1,, Work From Home Under Table Jobs · Digital Sales Representative (Work From Home) · Tier 1 Helpdesk Engineer (Work from home, but must live near. SF bay area "cash under the table" jobs - craigslist. All employees who work an average of 25+ hours per week are eligible · 3 comprehensive health plans available · Employer contribution: 50% for employee | 25% for. Jobs that Pay Under the Table · 1. Caterer · 2. Cleaning · 3. Selling crafts · 4. Pet sitter · 5. Dog walker · 6. Driver · 7. Selling stuff at the farmer's market · 8. work under the table jobs available in scarborough, ontario. See salaries, compare reviews, easily apply, and get hired. New work under the table. Looking for transit operator or maintenance jobs? You'll find employment opportunities for Tacoma Link light rail. Discover Pinterest's best ideas and inspiration for Under the table jobs. Get inspired and try out new things. Two women working at a table. Pin title reads. Child Labor: These provisions are designed to protect the educational opportunities of minors and prohibit their employment in jobs and under conditions.

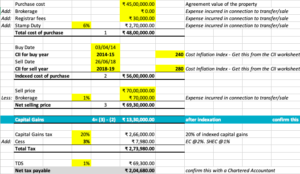

Capital Gains Selling Rental Property

Investors can defer taxes by selling an investment property and using the equity to purchase another property in what is known as a like-. When a primary residence is sold, it remains tax-free up to a certain monetary threshold. Beyond that threshold, taxes are assessed. This becomes a little more. When you sell a rental property in Canada, you must pay tax on 50% of the capital gain at your marginal tax rate. How long do I have to live in. Capital gains: You will need to pay capital gains tax on any profit made from the sale. Depreciation recapture: This taxes the amount of depreciation claimed. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. The capital gains tax rate for residents is 7%, but it can be reduced by up to 5% if you are over 59 ½ years kasin0123.site you are a nonresident of Connecticut, you. Capital gains on a rental property are the profits made from selling real estate assets. When these transactions are not profitable, they're referred to as. As of the current tax year, there are three main tax brackets for long-term capital gains: 0%, 15%, and 20%. The rate applied depends on the taxpayer's taxable. Taxation for long-terms gains falls somewhere between %, depending on which tax bracket you fall under. In , people in the 25% to 35% range will pay 15%. Investors can defer taxes by selling an investment property and using the equity to purchase another property in what is known as a like-. When a primary residence is sold, it remains tax-free up to a certain monetary threshold. Beyond that threshold, taxes are assessed. This becomes a little more. When you sell a rental property in Canada, you must pay tax on 50% of the capital gain at your marginal tax rate. How long do I have to live in. Capital gains: You will need to pay capital gains tax on any profit made from the sale. Depreciation recapture: This taxes the amount of depreciation claimed. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. The capital gains tax rate for residents is 7%, but it can be reduced by up to 5% if you are over 59 ½ years kasin0123.site you are a nonresident of Connecticut, you. Capital gains on a rental property are the profits made from selling real estate assets. When these transactions are not profitable, they're referred to as. As of the current tax year, there are three main tax brackets for long-term capital gains: 0%, 15%, and 20%. The rate applied depends on the taxpayer's taxable. Taxation for long-terms gains falls somewhere between %, depending on which tax bracket you fall under. In , people in the 25% to 35% range will pay 15%.

You may owe taxes on the profit (gain) you make from selling your property. This applies whether you held the property short-term (less than 1 year) or long-. As mentioned above, holding on to real estate investment for more than one year creates a long-term capital gain with a maximum tax rate of 20%. Otherwise, it's. You need to sell rental property, but you also don't want to pay hefty capital gains taxes. An ordinary exchange, which involves selling one like. The California tax on the sale of rental property includes long-term capital gains and short-term capital gains tax — along with depreciation recapture tax. Any profit you realize on the sale of rental property constitutes a capital gain that you must report in your income tax return. You will still owe capital gains tax, but it is a much lower rate: 15% for joint filers with taxable income ranging from $80, and $,; and 20% for joint. One of the essential tax considerations when selling your rental home is the capital gains tax. Capital gains tax applies to the profit made from the sale of an. When you sell a rental property, you may have to pay capital gains taxes and recaptured depreciation taxes, technically called unrecaptured section gain. You will still owe capital gains tax, but it is a much lower rate: 15% for joint filers with taxable income ranging from $80, and $,; and 20% for joint. When selling a rental property, you may need to pay either capital gains tax or corporation tax on the gains you make. The gain is generally calculated as. As Kiplinger reports, under President Biden's American Families Plan, people making more than $1 million per year would pay a % tax on long-term capital. In this article, we'll explain how taxes on capital gains work, and how to avoid paying capital gains tax on rental property. 1. Exchanges. The first strategy you can use to lower capital gains tax involves exchanges. You can use section to sell a rental property while. So, if you're a millionaire, your total capital gains taxes will be %. The math gets more complex when we factor in depreciation and depreciation recapture. If you sell the property for more than its tax basis, the excess is taxed as capital gains, BUT you will also have to “recapture” any allowed or. If you've invested in a rental property, odds are you'll be subject to long-term capital gains taxes since few investors sell their rental property in less than. The California tax on the sale of rental property includes long-term capital gains and short-term capital gains tax — along with depreciation recapture tax. If you are selling a home that used to be your primary residence, as long as you lived in the home for 2 of the last 5 years before selling, you. This is a long-term capital gain. The rate can range between 0% to 20% but most often falls around the 15% mark (to be sure we recommend you talk with the. Deferring Capital Gains Tax: Buying another home after selling an investment property within days can defer capital gains taxes. Although reinvesting.

How To Buy Stock When It Reaches A Certain Price

Stop Order. This is an order to buy or sell a security once the price of the security reaches a specified price, known as the "stop price." When. A limit order allows investors to buy or sell securities at a price they set or better stock reaches the limit price), or they can set an expiration date. A buy limit order is an order to purchase an asset at or below a specified price, allowing traders to control how much they pay. Market order is a buy or sell order in a stock market where investors only mention the quantity they want to buy or sell and the price is decided according to. Limit orders are filled only if the stock's market price reaches the limit price you entered within the time frame specified in your duration. While limit. If your price cannot be met, your order will be cancelled ('killed'). Enter your chosen price next to Limit Price. Unlike limit orders, you cannot set a time. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. When the stock hits a stop price that you set, it triggers a limit order. Then, the limit order is executed at your limit price or better. Investors often use. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. Stop Order. This is an order to buy or sell a security once the price of the security reaches a specified price, known as the "stop price." When. A limit order allows investors to buy or sell securities at a price they set or better stock reaches the limit price), or they can set an expiration date. A buy limit order is an order to purchase an asset at or below a specified price, allowing traders to control how much they pay. Market order is a buy or sell order in a stock market where investors only mention the quantity they want to buy or sell and the price is decided according to. Limit orders are filled only if the stock's market price reaches the limit price you entered within the time frame specified in your duration. While limit. If your price cannot be met, your order will be cancelled ('killed'). Enter your chosen price next to Limit Price. Unlike limit orders, you cannot set a time. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. When the stock hits a stop price that you set, it triggers a limit order. Then, the limit order is executed at your limit price or better. Investors often use. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept.

When the market price of the stock reaches or exceeds this level that is predetermined by the investor, the stop-limit order is initiated. Subscribe to. This ensures that the buy price does not exceed the specified level, offering a safeguard against further price escalation. Similarly, when a sell limit order. A limit order allows you to buy or sell a stock at a set price in the future. Only when the stock reaches the set price, or better, will the order be completed. You can set a GTC limit order to buy eight shares of Apple at $ apiece, or $1, in total. If Apple's stock reaches that desired price within two months. Stop Order. This is an order to buy or sell a security once the price of the security reaches a specified price, known as the "stop price." When this stop. A limit order lets you set the purchase or sell price for a security. The trade is executed only if the market price reaches or is better than the set limit. Stop-limit orders allow you to automatically place a limit order to buy or sell when an asset's price reaches a specified value, known as the stop price. This. A broker who is buying stock places a "bid" on your behalf which represents the maximum price that you will pay right now for a certain number. A Limit Order (buying). An order to buy a stock with a maximum price to be paid. The 'limit price' is set below the current market price and the. touches your specified price The price where you actually buy or sell a stock is the execution or the fill price. A stop-limit order triggers a limit order once the stock trades at or through your specified price (stop price). Your stop price triggers the order; the limit. A type of order used to buy or sell securities when the market price reaches a specified value, known as the stop price. Stop orders are generally used to. When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. You may place limit orders either. Stop: You can sell a security such as a stock if its price falls past a specified point, used to limit (i.e. “stop”) losses or lock in profits. (Buy stop orders. In other words, if you want to buy 50 shares of a stock when the price reaches $50, then you may have a buy-stop order that specifies the purchase of 50 shares. Stop-limit orders allow you to set a stop price and a limit price for a given security. Once a security reaches your stop price, the order is automatically. A stop-loss order is an instruction to buy or sell a stock when it reaches a certain price. A stop-loss order triggers a market order when a designated price is. A Limit order is an order to buy or sell at a specified price or better. The Limit order ensures that if the order fills, it will not fill at a price less. You can set a limit order for $55 that will activate as soon as the stock reaches this price, assuming your broker is able to find a buyer for your stock. A limit order is an order to buy or sell shares that is executed when the stock price reaches a certain price level. Limit orders will only fill at the price.

Off Grid Solar System Cost

Off-Grid Home Solar Power Systems ; Large Off Grid Solar and Stroage Kit AltE OFF GRID LG KITOFFGRIDLG Large Off Grid Solar and Stroage Kit, $42, Though a complete off-the-grid system can have a high price tag, it's often much more affordable than extending the electrical grid to remote properties, an. The cost of an off-grid solar panel system will vary depending on the size of the system and the quality of the components. However, you can expect to pay. Today's premium monocrystalline solar panels typically cost between $1 and $ per Watt, putting the price of a single watt solar panel between $ and. Entry Point: Off-grid system pricing typically starts around $15,, capable of powering small setups such as seasonal batches. Household Scale: For the. 15 x Canadian Solar W mono solar panel CS1HMS ( W); Magnum A Please contact us for the shipping rate. Reviews. There are no reviews yet. Assuming electric consumption is that of the U.S. national average, an off-grid solar system would cost between $30, – $48, The major price fluctuation. Battery storage makes off-grid expensive. The cost of an off-grid system for a typical Australian home (18kWh / day) ranges between $25, – $45, · Battery. On average, an off-grid solar system with batteries can cost upwards of $75, A residential grid-tied system typically ranges from $25, to $55, Off-Grid Home Solar Power Systems ; Large Off Grid Solar and Stroage Kit AltE OFF GRID LG KITOFFGRIDLG Large Off Grid Solar and Stroage Kit, $42, Though a complete off-the-grid system can have a high price tag, it's often much more affordable than extending the electrical grid to remote properties, an. The cost of an off-grid solar panel system will vary depending on the size of the system and the quality of the components. However, you can expect to pay. Today's premium monocrystalline solar panels typically cost between $1 and $ per Watt, putting the price of a single watt solar panel between $ and. Entry Point: Off-grid system pricing typically starts around $15,, capable of powering small setups such as seasonal batches. Household Scale: For the. 15 x Canadian Solar W mono solar panel CS1HMS ( W); Magnum A Please contact us for the shipping rate. Reviews. There are no reviews yet. Assuming electric consumption is that of the U.S. national average, an off-grid solar system would cost between $30, – $48, The major price fluctuation. Battery storage makes off-grid expensive. The cost of an off-grid system for a typical Australian home (18kWh / day) ranges between $25, – $45, · Battery. On average, an off-grid solar system with batteries can cost upwards of $75, A residential grid-tied system typically ranges from $25, to $55,

EG4 XP Off Grid Inverter 48V Split Phase /VAC. Basic – Offgrid Solar Panel Kit – Small $ Original price was: $ $ Current price is: $ Sale! Made from robust materials and monocrystalline cells, all EcoFlow's solar panels have a high conversion rate of up to 23%, meaning you can charge your Power. How much do grid-tied solar panel systems cost. We have a wide variety of packages from small systems to power only a few key loads to large packages that will power an entire house. See the cost guide below. As of February , the average cost of a kW Grid Tied solar panel starts at Php , For larger installations, such as a kW Grid Tie Solar system. Buy Together Save More · This item: Complete off Grid Solar Kit W 48V V/V output KWH Lithium Battery Watt Solar Panel SGKMAX $8, A grid-tie inverter converts direct current (DC) into an alternating current (AC) suitable for injecting into an electrical power grid, normally. WATT SOLAR WITH WATT INVERTER CHARGER OFF GRID / BACK UP. Sol-Ark Hybrid Inverter with Trina Watt Panels Solar Kits · Cost · $7, · $7, · $8, · $8, · $9, · $9, · $10, 20 products ; W 12V (4xW) Complete MPPT Off Grid Solar Kit · 5 reviews · $ · $ Save $ (28%) ; W 12V Complete Off Grid Solar Kit · 35 reviews. Expect to pay between $10, and $50, for a mixed DC and AC system, depending on the system size. These systems installed cost $11, to $55, on average. How much does it cost to install a solar energy system? The initial cost of installing a solar system is Rs. 25,, if you have already a single inverter. Microgreen's Power Pak off-grid solar system and its lithium battery storage makes living off the grid easy. It is a plug-and-play system that is easy to. Basic – Offgrid Solar Panel Kit – Small $ Original price was: $ $ Current price is: $ Sale! Approximate cost: $$ for a complete setup. Large system: Uses vAC and/or vAC; Uses 12vDC battery power only (no inverter required); Typically. How much does it cost to install a solar energy system? The initial cost of installing a solar system is Rs. 25,, if you have already a single inverter. 30kw Solar System Cost Off Grid On Grid Price and detail, how many pcs solar panels, how much power can a 30kw system produce, and what price. Off-grid solar panels provide energy for those who live remotely or don't want an association with utility. 6-Panel, 10KW AMENSOLAR Inverter, Hybrid/Battery Offgrid Kit From: $12, Original price was: $12, $10, Current price is: $10,

Default On Personal Loan Consequences

The exact credit score you need to be approved for a personal loan varies from lender to lender. How Forbearance Impacts Your Student Loans. Reading Time: 2. If you had a co-signer linked to the personal loan, the missed payments affect their credit score too. Also, they will receive calls from the lender and the. Late payments and accounts in default can stay on your credit reports for seven years, meaning you may face financial consequences for years to come.3 Not only. What Are the Consequences of a Default on a Personal Loan? Since a default negatively affects a borrower's payment history, it damages their creditworthiness. From credit score damage to legal repercussions and strained relationships, defaulting on a loan is a situation that should be carefully considered and avoided. The answer is no. If you default on an unsecured loan – your credit score is ruined. The lender sends your repayment activity report to the Credit Reference. What Are the Consequences of Defaulting on a Personal Loan? · Damage to Your Credit · Dealing with Debt Collectors · You Could Be Sued · A Cosigner Could Be. Have 2 giant personal loans(30k) that I feel like if I left them alone(12 months maybe less) for awhile I can dig my way out of this cc(30k)hole and then come. Student loans are another type of unsecured debt. Defaulting on a student loan has the same consequences as failing to pay off a credit card, affecting your. The exact credit score you need to be approved for a personal loan varies from lender to lender. How Forbearance Impacts Your Student Loans. Reading Time: 2. If you had a co-signer linked to the personal loan, the missed payments affect their credit score too. Also, they will receive calls from the lender and the. Late payments and accounts in default can stay on your credit reports for seven years, meaning you may face financial consequences for years to come.3 Not only. What Are the Consequences of a Default on a Personal Loan? Since a default negatively affects a borrower's payment history, it damages their creditworthiness. From credit score damage to legal repercussions and strained relationships, defaulting on a loan is a situation that should be carefully considered and avoided. The answer is no. If you default on an unsecured loan – your credit score is ruined. The lender sends your repayment activity report to the Credit Reference. What Are the Consequences of Defaulting on a Personal Loan? · Damage to Your Credit · Dealing with Debt Collectors · You Could Be Sued · A Cosigner Could Be. Have 2 giant personal loans(30k) that I feel like if I left them alone(12 months maybe less) for awhile I can dig my way out of this cc(30k)hole and then come. Student loans are another type of unsecured debt. Defaulting on a student loan has the same consequences as failing to pay off a credit card, affecting your.

Defaulting on a loan can lead to serious consequences, including the debt being passed on to collection agencies and/or being taken to court. It can lead to serious consequences, such as a damaged credit score, collections calls, wage garnishment, and seized collateral. To avoid loan defaults in the. They can also garnish your wages and your social security funds. In sum, they will take a fine tooth comb and analyze any and all business and personal assets. An event of debt default occurs when one or more terms in a loan agreement are violated (or breached) by a borrower. The consequences of defaulting on a student loan can include: · Ineligibility for additional federal aid or grants. · Severe damage to your credit report. In severe scenarios of loan default, the lender has the choice to file a civil suit, seeking repayment of the loan dues. This might result in court proceedings. If you have defaulted on your personal loans, it would make it harder for you to apply for credit in the future. If, in the future, there is a need for you to. If you default on your student loan: Your loans may be turned over to a collection agency. You'll be liable for the costs associated with collecting your loan. From credit score damage to legal repercussions and strained relationships, defaulting on a loan is a situation that should be carefully considered and avoided. I lend money through a personal loan company. I was curious what your experience was, or someone that you know that defaulted on their loans. If you do not take steps to deal with the debt, the loan will default, usually after two or three missed payments; Once the account has defaulted, the people. What Are the Consequences of Defaulting on a Personal Loan? · Impact on Credit Score · Collateral · Debt Collectors · Garnished Wages · Impact on Cosigner. What Are the Legal Consequences of Personal Loan Default in India? ; Lenders can file a case in a civil court seeking repayment. Defaulters may face asset. They can also garnish your wages and your social security funds. In sum, they will take a fine tooth comb and analyze any and all business and personal assets. Defaulting on a loan when you've signed a personal guarantee will likely impact your credit score for up to 10 years. If you default and haven't signed a. Defaulting on personal loan payments may have serious consequences that drastically impact your financial well-being and credit score. Defaults in India are a. If you do not take steps to deal with the debt, the loan will default, usually after two or three missed payments; Once the account has defaulted, the people. One of the foremost repercussions of defaulting on a personal loan is the detrimental effect on your credit score. Once a default occurs, the lender reports. What Are the Legal Consequences of Personal Loan Default in India? ; Lenders can file a case in a civil court seeking repayment. Defaulters may face asset. The consequences of defaulting on your private loans vary from lender to lender, but they may include your late payment being reported to the credit bureaus.

Best Financial Education Courses

Sign up for our best-in-class free financial education courses created by industry experts to help you along your personal financial journey. Degrees of Financial Literacy is a free program of the nation's certified public accountants to help Americans understand their personal finances through. Explore personal finance for managing money effectively. Learn about budgeting, saving, investing, and financial planning. Personal Finance, English, Released in , this course features a collection of videos and articles covering a range of topics from saving and investing to. Additional resources. · FINANCIAL LITERACY PROGRAM. Next Gen Personal Finance. Join educators working together to build a future where all young people take. Finance Course List · 1. Corporate Finance Institute: Corporate Finance Fundamentals · 2. Harvard Business School Online: Financial Accounting · 3. Harvard. This course will prepare you with foundational financial literacy knowledge to deliver financial education within your community. 13 Free Classes to Help You Manage Your Personal Finances (Like an Adult) · 1. The Core Four of Personal Finance, Udemy · 2. Personal Finance , Udemy · 3. Alison's "Introduction to Managing Your Personal Finance Debts" Alison — short for Advanced Learning Interactive Systems Online — is an education platform. Sign up for our best-in-class free financial education courses created by industry experts to help you along your personal financial journey. Degrees of Financial Literacy is a free program of the nation's certified public accountants to help Americans understand their personal finances through. Explore personal finance for managing money effectively. Learn about budgeting, saving, investing, and financial planning. Personal Finance, English, Released in , this course features a collection of videos and articles covering a range of topics from saving and investing to. Additional resources. · FINANCIAL LITERACY PROGRAM. Next Gen Personal Finance. Join educators working together to build a future where all young people take. Finance Course List · 1. Corporate Finance Institute: Corporate Finance Fundamentals · 2. Harvard Business School Online: Financial Accounting · 3. Harvard. This course will prepare you with foundational financial literacy knowledge to deliver financial education within your community. 13 Free Classes to Help You Manage Your Personal Finances (Like an Adult) · 1. The Core Four of Personal Finance, Udemy · 2. Personal Finance , Udemy · 3. Alison's "Introduction to Managing Your Personal Finance Debts" Alison — short for Advanced Learning Interactive Systems Online — is an education platform.

Offered through Coursera, this introductory financial planning course is designed to help students develop good financial habits during school and beyond. The. Our mission is to deliver unbiased financial literacy education that empowers Canadians to better their financial wellness. We deliver free financial. 2. Coursera Coursera is a for-profit educational company, but it offers hundreds of free online courses. The “free” option can be a good way to get to know. Each course helps adults explore the basics of each financial topic, explaining its impact in daily life and providing tips on how to apply best practices to. Learn about personal finance from a top-rated finance instructor. Whether you're interested in learning how to save money, make a budget. Voted one of the top personal finance websites for women, Clever Girl Finance® is a financial education platform aimed at providing women with financial. By leading and encouraging best practices education courses in high schools to ensure students receive comprehensive and equitable financial literacy. Learn how to budget, invest, and plan for your financial future with personal finance classes in NYC. Classes cover topics such as saving for retirement. EVERFI's free lesson library offers financial education curriculums for students in grades 4 through Each program offers a range of scenario-based. Connel Fullenkamp, Ph.D. I love that the The Great Courses gives me a chance I wouldn't otherwise have to teach people who love to learn. I. Financial Education (most commonly referred to as financial literacy) is defined by the National Financial Educations Council as, “Possessing the skills and. The Bottom Line · Wiley. "Personal Finance For Dummies, 10th Edition." · Penguin Random House. "Your Money or Your Life." · Hachette Book Group. "I Will Teach You. Trending courses · Finance and Accounting Tips. 3h 55m. Course. Finance and Accounting Tips · Corporate Financial Statement Analysis. 1h 28m. Course. Corporate. The FPYA course is organized across eight separate modules within a 4-week window. Topics covered include financial goal setting, saving and investing. Our practical and theoretical Personal Finance course covers personal income tax, wills, insurance, retirement, saving and investing, stocks, mutual funds and. In this exclusive online learning course, you will learn to overcome your fears and financial obstacles, explore how to become debt free, save for retirement. Better Money Habits is a free financial education platform for people from all walks of life to get practical, easy-to-understand knowledge about money. Build an intuitive understanding of financial principles to better understand the market in which your organization operates, create and access value. This online course helps you as front-line practitioners to gain the skills and knowledge required to become financially empowered and to successfully. Never invested? No need to worry. Invest with ease. Use this course to learn how best to use different options to save and invest your money, including the.

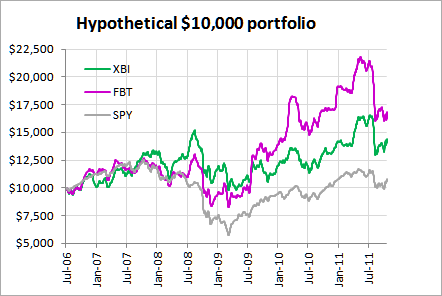

Fbt Etf Price

What was FBT's price range in the past 12 months? FBT lowest ETF price was $ and its highest was $ in the past 12 months. First Trust NYSE Arca Biotechnology ETF price and volume ; 52 Week Range. ; Day Range. ; Volume: K · 65 Day Avg: K ; Day Range ; 52 Week Range FBT - Stock Price Chart. Category, US Equities - Industry Sector, Asset Type, Equities (Stocks), Tags, U.S., Return% 1Y, %, Shs Outstand, Perf Week, %. First Trust NYSE Arca Biotechnology ETF FBT-CA:Toronto Stock Exchange · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High. Find the latest First Trust NYSE Arca Biotechnology Index Fund (FBT) stock quote, history, news and other vital information to help you with your stock. First Trust NYSE Arca Biotechnology Index Fund. Price: $ Change: $ (%). Category. FBT is a passive biotechnology ETF, which doesn't pay any dividend. Baring the past one year, FBT's price return has outperformed the S&P First Trust NYSE Arca Biotechnology Index Fund FBT:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date. What was FBT's price range in the past 12 months? FBT lowest ETF price was $ and its highest was $ in the past 12 months. First Trust NYSE Arca Biotechnology ETF price and volume ; 52 Week Range. ; Day Range. ; Volume: K · 65 Day Avg: K ; Day Range ; 52 Week Range FBT - Stock Price Chart. Category, US Equities - Industry Sector, Asset Type, Equities (Stocks), Tags, U.S., Return% 1Y, %, Shs Outstand, Perf Week, %. First Trust NYSE Arca Biotechnology ETF FBT-CA:Toronto Stock Exchange · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High. Find the latest First Trust NYSE Arca Biotechnology Index Fund (FBT) stock quote, history, news and other vital information to help you with your stock. First Trust NYSE Arca Biotechnology Index Fund. Price: $ Change: $ (%). Category. FBT is a passive biotechnology ETF, which doesn't pay any dividend. Baring the past one year, FBT's price return has outperformed the S&P First Trust NYSE Arca Biotechnology Index Fund FBT:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date.

First Trust NYSE Arca Biotechnology Index Fund (FBT) ETF Stock Forecast, Price Targets & Predictions - Get a free in-depth forecast of (FBT) ETF stock. FBT Portfolio Management. FBT Tax Exposure. FBT Fund Structure. FBT Fit prices due to differences in, among other factors, the time the trades were. Price currency, USD ; Domicile, United States ; Symbol, FBT ; Manager & start date. Roger Testin. 19 Jun Daniel Lindquist. 19 Jun Jon Erickson. 19 Jun. Get the latest First Trust NYSE Arca Biotechnology Index Fund (FBT) real The last closing price. $3, Year range. The range between the high and. First Trust NYSE Arca Biotech ETF FBT · NAV. · Open Price. · Bid / Ask / Spread. / / % · Volume / Avg. k / k · Day Range. Find the First Trust Exchange Traded Fund Nyse Arca Biotechnology Index Fund (FBT) options chain including strike prices, expiration dates, and volume data. Check out performance and key metrics like expense ratio, live pricing and top holdings for FBT on Composer to incorporate into your own algorithmic trading. Price Performance ; 1-Month. +%. on 05/30/ Period Open: ; 3-Month. +%. on 04/19/ Period Open: ; Week. +%. View the latest First Trust NYSE Arca Biotechnology Index Fund (FBT) stock price, news, historical charts, analyst ratings and financial information from. Fund Information · Market Price. $ · NAV. $ · Issuer. First Trust Advisors L.P. · Category. Health Care Equity · Assets(as of Jul 31, ). Find the latest quotes for First Trust NYSE Arca Biotechnology Index Fund (FBT) as well as ETF details, charts and news at kasin0123.site NYSEArca - Nasdaq Real Time Price • USD. First Trust NYSE Arca Biotechnology Index Fund (FBT). Follow. (%). As of PM EDT. Market Open. The investment seeks investment results that correspond generally to the price and yield (before the fund's fees and expenses) of an equity index called the. Performance charts for First Trust NYSE Arca Biotechnology Index Fund (FBT - Type ETF) including intraday, historical and comparison charts. First Trust NYSE Arca Biotech ETF Grades ; FBT Return (NAV), %, % ; FBT Return (Price), %, % ; NAV +/- Price Ret, %, % ; Health Avg, %, Assess the FBT stock price quote today as well as the premarket and after hours trading prices. What Is the First Trust NYSE Arca Biotech Ticker Symbol? FBT is. First Trust FBT ETF (First Trust NYSE Arca Biotechnology Index Fund ETF): stock price, performance, provider, sustainability, sectors, trading info. First Trust Nyse Arca Biotech Etf share price live: FBT Live stock price with charts, valuation, financials, price target & latest insights. The First Trust ETF provides exposure to its new index by investing all or substantially all of its assets in an underlying US index fund. Check if FBT Stock has a Buy or Sell Evaluation. FBT ETF Price (NYSEARCA), Forecast, Predictions, Stock Analysis and First Trust NYSE Arca Biotechnology.

Where Can You Upload Money To A Chime Card

Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. Add money1. Direct Deposit. Receive all or a portion of your pay directly into your Account You can link an external bank account you own to your Chime Checking Account in the Move Money section of the Chime app or by logging into your account online. As such, the only way to withdraw cash from Chime is using your debit card at an ATM or over-the-counter (which comes with a $ fee with a maximum withdrawal. Add cash to any eligible prepaid or bank debit card. · How it works · There are so many ways to use MoneyPak. deposit. It's possible that @bennash used the Square Card at a Chime ATM to withdraw funds instead. AshleyK. Community Moderator, Square Sign in and click. Sending money to a Chime account from a debit card directly is not typically possible; however, you can use a linked third-party service like. 1. Electronic funds transfer. Direct deposit is the simplest way to fund your Chime account. · 2. monetary deposit. If you have cash to deposit. Yes, you can load chime card at dollar general. Not only dollar general, you can also add money to other stores like Walmart and Target in your chime card. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. Add money1. Direct Deposit. Receive all or a portion of your pay directly into your Account You can link an external bank account you own to your Chime Checking Account in the Move Money section of the Chime app or by logging into your account online. As such, the only way to withdraw cash from Chime is using your debit card at an ATM or over-the-counter (which comes with a $ fee with a maximum withdrawal. Add cash to any eligible prepaid or bank debit card. · How it works · There are so many ways to use MoneyPak. deposit. It's possible that @bennash used the Square Card at a Chime ATM to withdraw funds instead. AshleyK. Community Moderator, Square Sign in and click. Sending money to a Chime account from a debit card directly is not typically possible; however, you can use a linked third-party service like. 1. Electronic funds transfer. Direct deposit is the simplest way to fund your Chime account. · 2. monetary deposit. If you have cash to deposit. Yes, you can load chime card at dollar general. Not only dollar general, you can also add money to other stores like Walmart and Target in your chime card.

Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. Create a Chime account · You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I. Go to your card info: · Enter an amount and tap Next. · Tap Instant Transfer. · If you haven't added an eligible debit card, tap Add Card and follow the. and may be used everywhere Visa debit cards are accepted. The secured Chime Credit Builder Visa® Credit Card is issued by The Bancorp Bank, N.A. or Stride Bank. It depends on the limit, you may only be able to put $ a day. If that's the case then you have to go back every day until you have all of the money on your. One of the most common ways to add money to your card is using a bank account. With that being said, I mean, you can transfer money from your. Load the Funds Once inside the store, pass your Chime card and the amount you wish to deposit to the cashier. Pay the Transaction Fee. Every retailer charges. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to spend your funds with. How to Move Your Money or Make a Deposit. Whether you're transferring funds using an external card, moving money between your Navy Federal accounts or. You can link your external account to your Chime Checking Account on the website under Settings > Linked Accounts. Direct deposit. · Bank transfer initiated through the Chime mobile app or website. · Bank transfers initiated from an external account. · Debit transactions. · Cash. Sending money to a Chime account from a debit card directly is not typically possible; however, you can use a linked third-party service like. K posts. Discover videos related to How to Add Money on Chime Card on TikTok. See more videos about How to Transfer Money from Chime to Chase, How to. Instant transfers: Instantly send funds to your linked bank account using your debit card 24 hours a day, 7 days a week, for a % fee per transfer. Same. Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. Load that with whatever is the amount on your gift card. So let's say it's 50 bucks. The card itself is $5, but you can load the 45 onto that card. You link. 7-Eleven, etc. Can I transfer. Where Can You Upload Money On A Chime Card CVS, Walmart, and Walgreens. From this point, you may use. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime Financial, Inc. is a San Francisco–based financial technology company that partners with regional banks to provide certain fee-free mobile banking.

Private Student Loans For People With Bad Credit

Basically the title. I have a poor credit score, but I need a loan. FASFA isnt gonna work. I only need to borrow $ and i can easily. Federal student loans are often the best option for students with bad credit because most of these loans don't require a credit check or a cosigner. Even if you. Best Student Loans for Bad Credit of August · Best Bad Credit Student Loan Companies · Sallie Mae · College Ave · Credible · SoFi · Ascent Funding · Earnest. When you apply for private student loans, the lender usually runs a credit check. If you have bad credit or no credit, you could be denied or offered a higher-. Use cosigners to your advantage—to help build your credit. Once you've made 48 consecutive on-time payments, it's common for your lender to release the cosigner. Choose the #1 Private Student Loan Lender in the Nation. Applying online is easy – you could receive a credit result in about 10 minutes. Apply Now · More. Private student loans require good credit to be approved, but applying with a cosigner can improve your odds if you have bad credit. The best student loan for bad credit is offered by Ascent, which offers flexible repayment terms for individuals with no cosigner or financial history. Direct PLUS loans: PLUS loans are the only federal student loans that require a credit check. People with an adverse credit history may still qualify for them. Basically the title. I have a poor credit score, but I need a loan. FASFA isnt gonna work. I only need to borrow $ and i can easily. Federal student loans are often the best option for students with bad credit because most of these loans don't require a credit check or a cosigner. Even if you. Best Student Loans for Bad Credit of August · Best Bad Credit Student Loan Companies · Sallie Mae · College Ave · Credible · SoFi · Ascent Funding · Earnest. When you apply for private student loans, the lender usually runs a credit check. If you have bad credit or no credit, you could be denied or offered a higher-. Use cosigners to your advantage—to help build your credit. Once you've made 48 consecutive on-time payments, it's common for your lender to release the cosigner. Choose the #1 Private Student Loan Lender in the Nation. Applying online is easy – you could receive a credit result in about 10 minutes. Apply Now · More. Private student loans require good credit to be approved, but applying with a cosigner can improve your odds if you have bad credit. The best student loan for bad credit is offered by Ascent, which offers flexible repayment terms for individuals with no cosigner or financial history. Direct PLUS loans: PLUS loans are the only federal student loans that require a credit check. People with an adverse credit history may still qualify for them.

While federal loans don't require a credit check, private student loans do. Many students don't qualify for private loans on their own because they don't have a. A:Yes, Private school loans for students with bad credit are available but are comparatively harder to find than finding private student loans for applicants. Private Loans: A student with poor negative credit history may enlist in a private lender loan if they can get a credit-worthy cosigner to shoulder the burden. When applying for a private loan, you can choose between fixed or variable interest rates, and the lender typically reviews your financial history and credit. Best for no co-signer: Funding U · Best for applying with a co-signer: College Ave · Best for long grace periods: Ascent · Best for flexible payment terms: Earnest. If you cannot qualify for need-based aid or you need more funding, you may want to consider private lenders. Personal loans, credit cards, and other sources of. Earnest is the top lender for those with bad credit, offering very low rates, flexible repayment terms, and loans for both undergraduate and graduate students. You can get a federal student loan without credit. Also, if your parents are in a low income bracket, you maybe able to get other grants. By all. The good thing for those with weak credit is that private lenders use the borrower's future ability to repay, whether they have a cosigner, and other. Direct Subsidized and Unsubsidized Loans from the federal government are your best option for student loans for bad credit, as they don't have a credit. One solution is to find a student loan that does not require a credit check or cosigner, such as the Federal Stafford Loan (including the Direct Subsidized for. Ascent offers private student loans without a cosigner. If you don't pre-qualify for our credit-based non-cosigned loan, eligible juniors and seniors may apply. Yes! Federal student loans usually don't require a credit check, and some private lenders specialize in loans for people without a strong credit history. Why do. One way to assuage lenders' fears when it comes to borrowing private student loans with bad credit is to find a cosigner. A cosigner is a person (usually with a. I think private loans are credit based. Have you looked into scholarships? Reach out to your student advisor. Or a payment plan. If you're. By comparison, private student loans are much harder to qualify for. The approval for this type of loan requires credit scores, income, and debt-to-income ratio. It's possible to get student loans if you have bad credit. Federal student loans should be your first option, followed by private student loans if you can't. Many students can't qualify for private loans because they don't have credit histories. The most common solution for this is to find cosigner. A cosigner agrees. Private student loans also tend to be more expensive, charging higher fees and higher interest rates than government loans. This will be especially true if you.