kasin0123.site Prices

Prices

If I Transfer Balances On My Credit Card

.jpg?1637650346)

When you get a balance transfer card, you can transfer balances from your other credit cards during the application process or right after you. A balance transfer credit card could offer you a chance to pay less interest while paying off – or at least reducing – your balance. If you move your account. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Yes, it is worth it to transfer a balance because it is a great way to refinance existing credit card debt. If you can get a lower interest rate in the process. Select your credit card. · Online banking: Choose Account services, then select Balance transfer from the "Payments" section. · Review the offers shown; when you. If you have a significant amount of credit card debt, the 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. Balance transfers between credit cards exist. There is a fee. If I can make payments on 0% APR without adding to the balance, it pays down quicker. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. You might also lower your overall. When you get a balance transfer card, you can transfer balances from your other credit cards during the application process or right after you. A balance transfer credit card could offer you a chance to pay less interest while paying off – or at least reducing – your balance. If you move your account. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Yes, it is worth it to transfer a balance because it is a great way to refinance existing credit card debt. If you can get a lower interest rate in the process. Select your credit card. · Online banking: Choose Account services, then select Balance transfer from the "Payments" section. · Review the offers shown; when you. If you have a significant amount of credit card debt, the 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. Balance transfers between credit cards exist. There is a fee. If I can make payments on 0% APR without adding to the balance, it pays down quicker. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. You might also lower your overall.

A balance transfer is when you move your existing credit card balance(s) to another credit card with a different provider. Instead, it's included in the available credit on your balance transfer card. For example, if you're approved for a balance transfer credit card with a $10, Do balance transfers hurt your credit? If you transfer balances between your existing cards, your credit score likely won't be impacted, but applying for any. Balance transfers work best when you can use them to decrease your cost of borrowing by lowering the interest rate you're paying by taking advantage of an. In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise. A balance transfer is when you move money you owe from one credit card to another that charges less in interest. A balance transfer is a way to move money owed on one credit card or loan (debt) to another credit card for the purpose of saving money on interest. If you don'. With no grace period, if you make any purchases on your new credit card after completing your balance transfer, then you'll incur interest charges on those. A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Balance transfers can affect your credit score depending on a few factors, like if you open a new card to transfer a balance and what you do once your balances. Balance transfers can also simplify bills by consolidating several balances with different creditors onto one card with one payment. Say you have a credit card. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. Balance transfers will not earn Capital One rewards · Continue to make your credit card and loan payments until you confirm that the transferred payment has been. How Do Balance Transfers Work? When you transfer a balance to a credit card, the issuer of that card makes a payment to your original lender. The amount of. When you transfer your balance to a new credit card, that card's issuer pays off your debt with the original lender, usually another credit-card company. When you consolidate all your higher-rate credit card debt--or other outstanding debts--with a Discover balance transfer offer, you end up with a single monthly. For example, your balance transfer card may offer 0% intro APR on transfers but 18% APR on purchases. If you transferred $2, to this card, you would be. How will the Balance Transfer post to my account? Once you transfer a balance to a new credit card, you might assume that your old card has a $0 balance, but it may not. “Make sure no last-minute interest or. A balance transfer is when you move credit card debt from a high-interest card to a zero-interest card to save money. Sounds simple enough, and if you're.

Online Gambling That Pays

The best real money online casinos for US players will boast generous bonuses, and our reviews look to find the most comprehensive welcome offers for new US. Paying attention to these updates will ensure you're not violating any regulations. Nevada state Legal for Gambling. New Jersey: Pioneering online gambling. Pick from our top 10 real money online casinos and claim a lucrative bonus. Play real money slots, blackjack, and roulette. It includes a wide variety of businesses that juggle large transactions (often in cash) at a rapid scale, such as physical casinos, online casinos, bars and. The home of online casino games, including Slots, Blackjack, the #1 Live Casino in the US, Roulette & more at FanDuel Casino. Our experts have compiled a list of the best online casinos that payout. Expect casinos payout between % and %. Slot machines, blackjack, roulette, video poker, and every other game are available instantly via real money online casino apps and websites. What instant online casinos pay out the fastest? The best fast payout online casinos in the US are Wild Casino, kasin0123.site, and Bovada. These sites process and. FanDuel Casino is the #1 Rated Online Casino app, where you can play fully regulated online casino games for real money in Michigan, Pennsylvania, New Jersey. The best real money online casinos for US players will boast generous bonuses, and our reviews look to find the most comprehensive welcome offers for new US. Paying attention to these updates will ensure you're not violating any regulations. Nevada state Legal for Gambling. New Jersey: Pioneering online gambling. Pick from our top 10 real money online casinos and claim a lucrative bonus. Play real money slots, blackjack, and roulette. It includes a wide variety of businesses that juggle large transactions (often in cash) at a rapid scale, such as physical casinos, online casinos, bars and. The home of online casino games, including Slots, Blackjack, the #1 Live Casino in the US, Roulette & more at FanDuel Casino. Our experts have compiled a list of the best online casinos that payout. Expect casinos payout between % and %. Slot machines, blackjack, roulette, video poker, and every other game are available instantly via real money online casino apps and websites. What instant online casinos pay out the fastest? The best fast payout online casinos in the US are Wild Casino, kasin0123.site, and Bovada. These sites process and. FanDuel Casino is the #1 Rated Online Casino app, where you can play fully regulated online casino games for real money in Michigan, Pennsylvania, New Jersey.

Blackjack. Blackjack is normally the highest RTP game available at the best online casinos that payout instantly. There are several different blackjack. Comparing the Top Online Casino Sites ; DuckyLuck, % up to $2, + Free Spins, 30x ; Wild Casino, % up to $3,, 45x ; Super Slots, % up to $4, The Best Real Money Casino Bonuses As well as award-winning poker content, PokerNews also offers you the latest content for online casino games, slots, and. online slots reviews for a shortcut to the very best games the internet has to offer. Big Jackpot Online Gambling logo. Play for free Play for money More Slots. Uncover real money online casinos and experience the best from BetMGM, FanDuel, DraftKings, and more! Enjoy favorites for games such as slots and blackjack. kasin0123.site is a fast payout online casino USA that has become popular because of its captivating jungle theme and the fantastic gameplay and graphics in all. Top Real Money Casinos · BitStarz Casino · Kakadu Casino · N1 Casino · Wallacebet Casino · CrocoSlots Casino · Gamblezen Casino · kasin0123.site · Flappy Casino. The fastest payout online casino is Wild Casino. The site offers over 10 cryptocurrencies, many of which payout instantly. Make BetMGM your one-stop online casino. % Deposit Match Welcome Offer. Slots, Blackjack, Roulette, Craps & Live Dealer Experience. The fastest cashouts at online casinos are typically offered by e-wallets like PayPal, Skrill, and Neteller, and cryptocurrencies like Bitcoin. These payment. Bovada is the most popular crypto casino in the US. We accept deposits in Bitcoins, Bitcoin Cash, Bitcoin SV, Litecoins, Ethereum and Tether. Red Dog casino is probably the best online casino app that actually pays out real money. They're a legit real money casino where you can deposit. Find the best legal online casinos available to US casino players. Includes welcome bonuses, top games and where to play for real money. Best real money online casinos games including Caesars Palace and FanDuel Casino are gaining popularity in the US and while legal sports betting is still more. Take a spin around the DraftKings Casino app and get closer to the games you love. Choose from over real money games: slots, blackjack, roulette, and live-. In this guide, you'll discover four legit online casinos that pay real money and accept US players. We've broken down everything you need to know. While this house advantage varies for each game, it ultimately helps to ensure that over time, the casino won't lose money to gamblers. For people who are. Roulette: When playing roulette at real money online roulette casinos, you'll find an array of wagers, whatever your gambling style. Whether you're after the. The best online casinos in Pennsylvania are Caesars, BetMGM, FanDuel, and BetPARX. See our ratings for the best online casino gaming experience in

List Of Us Regulated Forex Brokers

Forex Broker List ; IBFX, NFA(US), CFTC(US), Up to ; ICM Captial, FSA United Kingdom, ; ; Integer Capital Markets LTD (NZD), Up to Find the 7 best US Forex brokers, all regulated for secure trading and catering to both beginners & seasoned traders. Grow your forex portfolio! This is a list of Forex brokers that work with the currency traders from the United States of America. These brokers are either registered with NFA (and. Advanced Futures (Global Futures Exchange & Trading Co., Inc.) AFT-FX (AFT Co., Ltd.) Ajax Financial Inc. ATC Brokers (Avail Trading Corp.) Ava FX (Ava. Regulated forex brokers in the US. The United States is at the forefront of Below you will find a list of Forex brokers regulated by BaFin. BaFin. 4 Best Forex Brokers Accepting US Traders in ; US-traders ; kasin0123.site · kasin0123.site ; OANDA · OANDA ; IG · IG ; InteractiveBrokers · InteractiveBrokers. RED List: Forex Broker Inc. This entity operates outside the United States with no or limited U.S. presence. It is soliciting and/or accepting funds from U.S. Finding regulated Forex brokers accepting US clients can be a bit limited due to strict rules. However, some brokers I known for accepting US. forex brokers for us traders ; ATC Brokers · View ATC Brokers Details. View Profile · Interactive Brokers · View Interactive Brokers Details. View Profile. Forex Broker List ; IBFX, NFA(US), CFTC(US), Up to ; ICM Captial, FSA United Kingdom, ; ; Integer Capital Markets LTD (NZD), Up to Find the 7 best US Forex brokers, all regulated for secure trading and catering to both beginners & seasoned traders. Grow your forex portfolio! This is a list of Forex brokers that work with the currency traders from the United States of America. These brokers are either registered with NFA (and. Advanced Futures (Global Futures Exchange & Trading Co., Inc.) AFT-FX (AFT Co., Ltd.) Ajax Financial Inc. ATC Brokers (Avail Trading Corp.) Ava FX (Ava. Regulated forex brokers in the US. The United States is at the forefront of Below you will find a list of Forex brokers regulated by BaFin. BaFin. 4 Best Forex Brokers Accepting US Traders in ; US-traders ; kasin0123.site · kasin0123.site ; OANDA · OANDA ; IG · IG ; InteractiveBrokers · InteractiveBrokers. RED List: Forex Broker Inc. This entity operates outside the United States with no or limited U.S. presence. It is soliciting and/or accepting funds from U.S. Finding regulated Forex brokers accepting US clients can be a bit limited due to strict rules. However, some brokers I known for accepting US. forex brokers for us traders ; ATC Brokers · View ATC Brokers Details. View Profile · Interactive Brokers · View Interactive Brokers Details. View Profile.

Voted Best US Forex Broker (Compare Forex Brokers Awards ). Voted Best We are a fully regulated forex broker, with offices in nine regions globally. Forex traders would prefer to open trading accounts from FCA regulated forex brokers The US regulatory framework is deemed as one of the world's strictest. US. how about a list of A book brokers available in the USA, I went through about 20 and haven't found one. I'm looking for a Forex broker that's A Book. Thanks. US-based forex brokers are overseen by a large number of regulatory agencies. Among these are the Commodity Futures Trading Commission (CFTC), the Securities. Leading regulated US forex brokers include IG, kasin0123.site, Interactive Brokers, TD Ameritrade FX, and Saxo Bank. All of these brokers hold active CFTC and NFA. Below is a list of regulated brokers for US citizens. These brokers all link with the charting from step #1. Interactive Brokers · Oanda · TD Ameritrade. USEFUL. Two United States Forex Regulatory Agencies; U.S. Regulations and Forex Brokerage Accounts; NFA Regulates Forex Trading; U.S. Regulated Forex Brokers; Strict. US-based forex brokers are overseen by a large number of regulatory agencies. Among these are the Commodity Futures Trading Commission (CFTC), the Securities. Some of the well-known forex brokers include IG Group, Saxo Bank, Plus, and eToro. These brokers offer various trading platforms, educational resources, and. Forex Brokers Regulated by CFTC/NFA ; ASIC, CFTC/NFA, CIMA, CySEC, FCA, IIROC, JFSA, MAS. Regulated via parent company StoneX Group Inc. Warren, United. Find Forex Brokers By Regulation Authority below. On each page, you can find complete information about each regulatory entity and Forex brokers that are. Best Forex Brokers in the USA ; TradeStation, Open Account, 0 USD, SEC, CFTC, FINRA, NFA, ✔️ ; eToro USA LLC, Open Account, USD, CySEC, FCA, ASIC, FSA, NFA. As America's number 1 broker*, we're regulated, financially stable and have provided our clients with trading services since Financial security. Blue. Find below the Top Forex Brokers List ; Amana Capital | Review & Rating · Be first people review it. ; AMarkets | Review & Rating · 9 ratings ; AMEGA | Review &. Similar to TD Ameritrade, kasin0123.site is publicly traded and highly regulated. The company generates the majority of its revenue from spreads, while new customers. We've chosen OANDA as the best of the US-regulated forex brokers due to its accessible trading platform, excellent reputation and competitive trading fees. Regulated Forex Brokers · PayPal · Skrill · Wire transfer · Credit/debit cards · Neteller · UnionPay · Bitcoin · Tether (USDT). ⭐ Forex Brokers List ; ActivTrades. £ ; ACX. 1 $. 1 $. ; ACY Securities. 50 $ ; Admirals. $. List of Brokers by USA Clients Accepted: ; ATC BROKERS, YES ; ATS MARKETS GLOBAL, YES ; BuzzFX, YES ; Capital Street FX, YES. Commodities Futures Trade Commission (CFTC) · National Futures Association (NFA) · How can I learn more about the forex broker with whom I am trading? · What.

How Is The S&P 500 Weighted

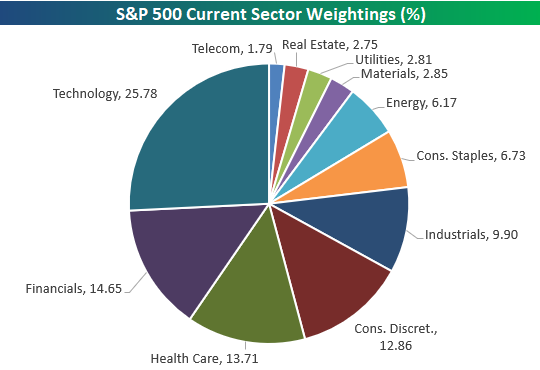

S&P ETF Components. This list shows the holdings of the SPDR S&P ETF Trust (SPY). #, Company, Symbol. The S&P is widely regarded as the best single gauge of large-cap US equities and serves as the foundation for a wide range of investment products. Constructed on a market capitalization-weighted basis, the S&P index designates a percent weight to each constituent based on the value of its equity. On average, the S&P makes approximately two changes to its stock components each year. However, this number can vary significantly depending. The fund aims to achieve a return on investment, through capital and income returns on its assets, which reflects the return of the S&P Equal Weight. The S&P ® Equal Weight Index aims to reflect the performance of the following market: The Largest companies listed in the USA; Covers approximately 80%. The market cap weighted S&P Index (the traditional version) is not rebalanced and has higher concentrations to larger, growth companies, while the equal. The S&P Equal Weight Index allocates the same weight to all names in the S&P Index, presenting new opportunities to trade the major US benchmark. The Invesco S&P ® Equal Weight ETF (Fund) is based on the S&P ® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in. S&P ETF Components. This list shows the holdings of the SPDR S&P ETF Trust (SPY). #, Company, Symbol. The S&P is widely regarded as the best single gauge of large-cap US equities and serves as the foundation for a wide range of investment products. Constructed on a market capitalization-weighted basis, the S&P index designates a percent weight to each constituent based on the value of its equity. On average, the S&P makes approximately two changes to its stock components each year. However, this number can vary significantly depending. The fund aims to achieve a return on investment, through capital and income returns on its assets, which reflects the return of the S&P Equal Weight. The S&P ® Equal Weight Index aims to reflect the performance of the following market: The Largest companies listed in the USA; Covers approximately 80%. The market cap weighted S&P Index (the traditional version) is not rebalanced and has higher concentrations to larger, growth companies, while the equal. The S&P Equal Weight Index allocates the same weight to all names in the S&P Index, presenting new opportunities to trade the major US benchmark. The Invesco S&P ® Equal Weight ETF (Fund) is based on the S&P ® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in.

How Is The S&P EQUAL WEIGHTED Doing Today? The S&P EQUAL WEIGHTED live stock price is 7, What Is the S&P EQUAL WEIGHTED Ticker Symbol? SPXEW1. S&P equal-weight ETFs in vogue as investors avoid big tech S&P equal-weight ETFs have returned to asset gathering territory as investors either profit. Replicating the performance of the S&P can be done by investing in index funds and ETFs designed with the exact weighting of stocks. Index funds can be. The S&P is regarded as a gauge of the large cap US equities market. The index includes leading companies in leading industries of the US economy. The S&P is a float-adjusted market-cap-weighted index. Float-adjusted market cap is a measure of company size that is calculated by multiplying a. S&P - ETF components iShares Core S&P ETF - USD. Add to a list change. 1st Jan change. Weight. APPLE INC. Stock Apple Inc. USD, %, +. Market Cap-Weighted Index. Over time, traditional market-cap weighted indexes such as the S&P and the Russell have been shown to outperform most active. How Is The S&P EQUAL WEIGHTED Doing Today? The S&P EQUAL WEIGHTED live stock price is 7, What Is the S&P EQUAL WEIGHTED Ticker Symbol? SPXEW1. The fund aims to achieve a return on investment, through capital and income returns on its assets, which reflects the return of the S&P Equal Weight. Get S&P Equal-Weighted Index .SPXEW:Exchange) real-time stock quotes, news, price and financial information from CNBC. Both market-capped weighting and equal-weighting are good. Either one will serve you well. But neither of them are perfect. The individual market weights are calculated by dividing the free-float market capitalization of a company in the index by the total market capitalization of. The Invesco S&P ® Equal Weight ETF (Fund) is based on the S&P ® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in. RSP is a unique equal weight strategy that has 75% lower management fees than its peers and hasn't paid a capital gains distribution since its inception in. It is a compilation of stocks like the S&P which you can find more about here. Basically, you invest money into a basket of stocks. A higher. Weighting Formula and Calculation of the S&P Weighting Formula and Calculation of the S&P The S&P uses a market-cap weighting method. Analyze the Fund Invesco Equally-Weighted S&P Fund Class A having Symbol VADAX for type mutual-funds and perform research on other mutual funds. Because the index is weighted by market capitalization -- the number of shares on the market times share price -- higher-value companies take up bigger. An equal-weighted index fund, on the other hand, takes the same set of companies, and invests in them as equally as it can. An S&P equally weighted. SPEW | A complete S&P Equal Weight Index index overview by MarketWatch. View stock market news, stock market data and trading information.

Why Are Cars Selling Above Msrp

Cars often command prices above MSRP when demand surpasses supply, allowing sellers to capitalize on buyers willing to pay a premium. This practice was. With that understanding, it's easy to see why manufacturers put sales incentives in place for their dealers. Manufacturers need dealers to move as many cars as. Depending on the year, make and model a car generally sells for 1% to nearly 10% below MSRP. The out the door (OTD) price is a different matter. Most experts argue that MSRP does little to affect vehicle costs and sales. In fact, more and more auto dealers have been found to sell way above the suggested. This sticker price is what the manufacturer suggests the dealerships sell the vehicles for, but it is in no way an obligation. It also does not reflect the. It is not a law, nor are you required to pay MSRP on a new car. The letters mean: Manufacturer's SUGGESTED Retail Price. Dealers are free to. MSRP stands for maximum suggested retail price, which is not a necessity to obey. Anyway, if a costumer would see this unfair pricing, he will. A dealership can charge more for a car than a private seller because it spends money on reconditioning, handles the paperwork, and offers a special value to. Conversely, stores may set prices higher than the MSRP if a product is in high demand and is likely to sell quickly. The automotive industry frequently uses. Cars often command prices above MSRP when demand surpasses supply, allowing sellers to capitalize on buyers willing to pay a premium. This practice was. With that understanding, it's easy to see why manufacturers put sales incentives in place for their dealers. Manufacturers need dealers to move as many cars as. Depending on the year, make and model a car generally sells for 1% to nearly 10% below MSRP. The out the door (OTD) price is a different matter. Most experts argue that MSRP does little to affect vehicle costs and sales. In fact, more and more auto dealers have been found to sell way above the suggested. This sticker price is what the manufacturer suggests the dealerships sell the vehicles for, but it is in no way an obligation. It also does not reflect the. It is not a law, nor are you required to pay MSRP on a new car. The letters mean: Manufacturer's SUGGESTED Retail Price. Dealers are free to. MSRP stands for maximum suggested retail price, which is not a necessity to obey. Anyway, if a costumer would see this unfair pricing, he will. A dealership can charge more for a car than a private seller because it spends money on reconditioning, handles the paperwork, and offers a special value to. Conversely, stores may set prices higher than the MSRP if a product is in high demand and is likely to sell quickly. The automotive industry frequently uses.

SANTA MONICA, CA — February 15, — More car shoppers than ever are paying above sticker price amid inventory shortages and elevated consumer demand. Dealer markup refers to the additional amount that a dealer adds to the MSRP of a vehicle. It's a way for dealerships to generate extra profit on the sale. Like the end of the calendar year, the end of the model year is a prime time for buying a car. Dealers offer more discounts and rebates at the end of a model. Automotive savings exclusively for Costco members. Go car shopping without the hassle and get low, prearranged pricing. Find an Approved Dealer near you. A year ago, the average new car was priced at $45,, or percent above MSRP, but today the average new car is priced at $45,, or percent above MSRP. Find your next new car, used car, truck, or SUV including pricing and features, find a car dealer near you, calculate payments or make a service appointment. 10 cars, SUVs, and trucks that are selling over their MSRP. Notably, every model featured on the list is being sold at 7 percent or higher above the MSRP. 10 cars, SUVs, and trucks that are selling over their MSRP. Notably, every model featured on the list is being sold at 7 percent or higher above the MSRP. So how can a shopper get a lower price than MSRP? Many dealers do not outright own the vehicles they are selling on their own lots. They are often “rented” to. Cars often command prices above MSRP when demand surpasses supply, allowing sellers to capitalize on buyers willing to pay a premium. This practice was. Because of this wiggle room, you may see asking prices above the MSRP for a hot, high-demand vehicle. In times when vehicles are selling slowly, the price may. Most experts argue that MSRP does little to affect vehicle costs and sales. In fact, more and more auto dealers have been found to sell way above the suggested. Looking to buy a car? You might see dealers advertising unusually low prices, low or no up-front payments, low- or no-interest loans, or low monthly. It is legal. Our dealership only prices a vehicle above MSRP on vehicles that has like a Shelby addition or something like it. Why are cars going over MSRP? Is it because there's a lack of supply, so the dealers force you to buy add-ons? And if you don't, they'll just sell to the “next. So how can a shopper get a lower price than MSRP? Many dealers do not outright own the vehicles they are selling on their own lots. They are often “rented” to. Because of this wiggle room, you may see asking prices above the MSRP for a hot, high-demand vehicle. In times when vehicles are selling slowly, the price may. Therefore, if a car dealer sold you a car or truck for more than the price at which the vehicle was advertised, then the dealer likely violated the law, and it. This sticker price is what the manufacturer suggests the dealerships sell the vehicles for, but it is in no way an obligation. It also does not reflect the. A year ago, the average new car was priced at $45,, or percent above MSRP, but today the average new car is priced at $45,, or percent above MSRP.

How Much Equity Can I Take Out Of My Home

Instead, they can tap into their equity through a home equity loan, a home equity line of credit (HELOC), or a cash-out refinance. Key Takeaways. Home equity is. After you buy a house, the value of your home equity can change and hopefully it will increase. How can your home equity increase? You can increase your home. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. You usually need to have at least 20% in home equity to refinance. Refinancing can also give you an opportunity to get rid of a mortgage insurance premium (MIP). How Does a HELOC Work? A HELOC is a line of credit guaranteed by the equity in your home. HELOCs are interest-only loans taken out over a specific period, for. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. In most cases, you can only borrow up to roughly 80% of the home's value. You take out a new mortgage that pays off the old and then gives you a payout of the. To figure out how much equity you have in your home, subtract the amount you owe on all loans secured by your house from its appraised value. Many lenders have a maximum CLTV ratio of 80%. If your home is worth $, and you have no existing mortgage, the maximum you could borrow would be 80% or. Instead, they can tap into their equity through a home equity loan, a home equity line of credit (HELOC), or a cash-out refinance. Key Takeaways. Home equity is. After you buy a house, the value of your home equity can change and hopefully it will increase. How can your home equity increase? You can increase your home. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. You usually need to have at least 20% in home equity to refinance. Refinancing can also give you an opportunity to get rid of a mortgage insurance premium (MIP). How Does a HELOC Work? A HELOC is a line of credit guaranteed by the equity in your home. HELOCs are interest-only loans taken out over a specific period, for. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. In most cases, you can only borrow up to roughly 80% of the home's value. You take out a new mortgage that pays off the old and then gives you a payout of the. To figure out how much equity you have in your home, subtract the amount you owe on all loans secured by your house from its appraised value. Many lenders have a maximum CLTV ratio of 80%. If your home is worth $, and you have no existing mortgage, the maximum you could borrow would be 80% or.

Most lenders require that you have at least a 15 to 20 percent equity stake in your home. This is calculated by finding your loan-to-value ratio (LTV). For example, if you apply for a conventional cash-out refinance, the max LTV ratio is 80%. Written in a formula, the calculation looks like this: (Appraised. Retired homeowners who have paid off their mortgage can sell their home and cash out the equity by downsizing. Further, homeowners 62 and older have the option. You can get a home equity loan that isn't a line of credit. Beware that many of those applications will ask you what the money is for, and if. Find out the estimated value of your home by answering a few questions. Plus, see how much a renovation project could increase the value of your home. Get. As long as you own 25% of your home, you can pull equity out of it. As for the speed of the application processes, it'll be different for every lender. You. Lenders generally won't allow you to borrow % of the value of your home. In certain market conditions, you may be able to borrow up to 90 or even 95% of the. The most common options for tapping the equity in your home are a HELOC, home equity loan or cash-out refinance. Home equity loans and HELOCs have roughly. The combined loan-to-value ratio of your loans cannot exceed 85% of the home's value. To find out how much you can borrow, multiply your home's appraisal. Let's Break it Down: Most lenders will let you borrow up to 85% of your home's value. Here's how you can figure it out using the calculator. So, you can get an 80% loan to home value first mortgage, a 10% loan to value second mortgage, and you'll have to put 10% down. For instance, if your house is. To calculate home equity, take the amount your property is currently worth, or the appraised value, and subtract the amount of any existing mortgages on your. Your home equity gives you financial flexibility. Find out how much you may qualify to borrow through a mortgage or line of credit. Maximum loan amount for primary residences is $1,, Second/Vacation home: For lines up to $,, we will lend up to 80% of the total equity in your. Get my rate. HOME EQUITY CALCULATOR. How much home equity can you tap into? Use this calculator to estimate the maximum credit line or loan amount you could. You can get a home equity loan that isn't a line of credit. Beware that many of those applications will ask you what the money is for, and if. “Pull out” from equity means you are using equity in your property as collateral to borrow against, so obviously you will owe more than before. A loan-to-value ratio is calculated by taking total mortgage debt (including any second mortgages or existing home equity loans) and dividing it by the current. Get home equity loan payment estimates with U.S. Bank's home equity loan & home equity line of credit (HELOC) calculator. Check terms and rates today!

Financial Literacy Information

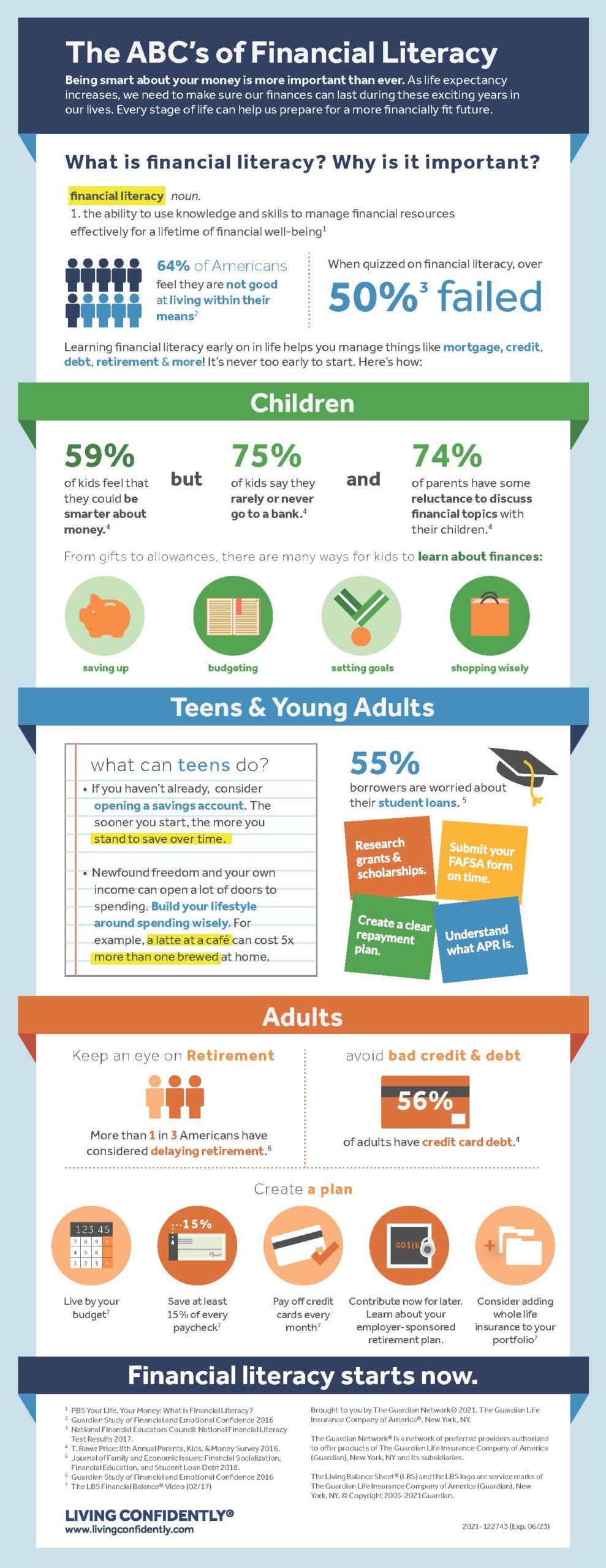

Financial literacy is the ability to understand the use of money as it applies to your personal finances, according to the National Financial Educators. Financial literacy empowers individuals to make informed choices, avoid pitfalls, know where to go for help, and take actions to improve their present and long-. Financial literacy can help you avoid debt, save money, and learn to make money work for your long-term financial goals. Successful national financial literacy strategies and programmes should be based on comparable data that enables economies to benchmark themselves, identify. Financial literacy is an essential tool in creating a strong economy. It teaches kids the importance of money management and has myriad benefits. Facts About Youth Financial Knowledge & Capability · The average loan student debt for students graduated from college in was $37, · The average college. Financial literacy is the ability to use important money skills, including budgeting and saving. Learn more about financial literacy and how to achieve it. online information and resources; publications; sponsors and partners. What is the mission of CPA Canada Financial Literacy? Our mission is to deliver unbiased. Key steps to attaining financial literacy include learning how to create a budget, track spending, pay off debt, and plan for retirement. Financial literacy is the ability to understand the use of money as it applies to your personal finances, according to the National Financial Educators. Financial literacy empowers individuals to make informed choices, avoid pitfalls, know where to go for help, and take actions to improve their present and long-. Financial literacy can help you avoid debt, save money, and learn to make money work for your long-term financial goals. Successful national financial literacy strategies and programmes should be based on comparable data that enables economies to benchmark themselves, identify. Financial literacy is an essential tool in creating a strong economy. It teaches kids the importance of money management and has myriad benefits. Facts About Youth Financial Knowledge & Capability · The average loan student debt for students graduated from college in was $37, · The average college. Financial literacy is the ability to use important money skills, including budgeting and saving. Learn more about financial literacy and how to achieve it. online information and resources; publications; sponsors and partners. What is the mission of CPA Canada Financial Literacy? Our mission is to deliver unbiased. Key steps to attaining financial literacy include learning how to create a budget, track spending, pay off debt, and plan for retirement.

Being financially literate means having the knowledge, skills, and confidence to manage your personal finances effectively. In this context, financial skill is knowing how to find, process, and take action based on information and self-efficacy is confidence in one's ability to reach. Financial literacy education provides students the tools and skills necessary to make informed financial decisions, particularly in regards to the student loan. What is Financial Literacy? · How to Become Financially Literate · Saving vs. · How to Set a Budget (and Stick to It) · Money Management for the Everyday Me. Financial literacy is the cognitive understanding of financial components and skills such as budgeting, investing, borrowing, taxation, and personal financial. Being "financially literate" means you have the knowledge, skills and habits to successfully manage your money. A growing body of research shows a wide. Financial literacy: The more you know, and the more tools In this guide, you'll find information on budgeting, credit, saving and investing, and taxes. “There is a knowledge gap among kids in the world,” Booth says. “Some have access to information from parents, schools and other forms of financial literacy. Financial literacy involves concepts like budgeting, building and improving credit, saving, borrowing and repaying debt, and investing. · Becoming more. JA Financial Literacy is a one-semester teacher-led course that equips high school students with foundational personal finance skills. Financial literacy is a good skill because it gives us the ability and knowledge, we need to manage our money efficiently. It improves our financial well-being. Successful national financial literacy strategies and programmes should be based on comparable data that enables economies to benchmark themselves, identify. Financial education is most effective when it meets participants where they are at in their financial lives and tailors information and education to their needs. The results of a Eurobarometer survey on financial literacy published in July by the European Commission show that only 18% of EU citizens have a high. information and resources to help you better understand events and choices that impact your personal finances. The information does not identify every. Financial literacy refers to the ability to understand and apply different financial skills effectively, including personal financial management, budgeting. Financial literacy refers to the ability to understand and apply different financial skills effectively, including personal financial management, budgeting. Being financially literate means having the knowledge and confidence to effectively manage, save and invest money for you and your family. The Financial Literacy and Education Commission was established under the Fair and Accurate Credit Transactions Act of The Commission was tasked to. General Financial Literacy Statistics · 25% of Americans say they don't have anyone they can ask for trusted financial guidance. · In , 28% of adults reported.

Best Places For Over 55 To Live

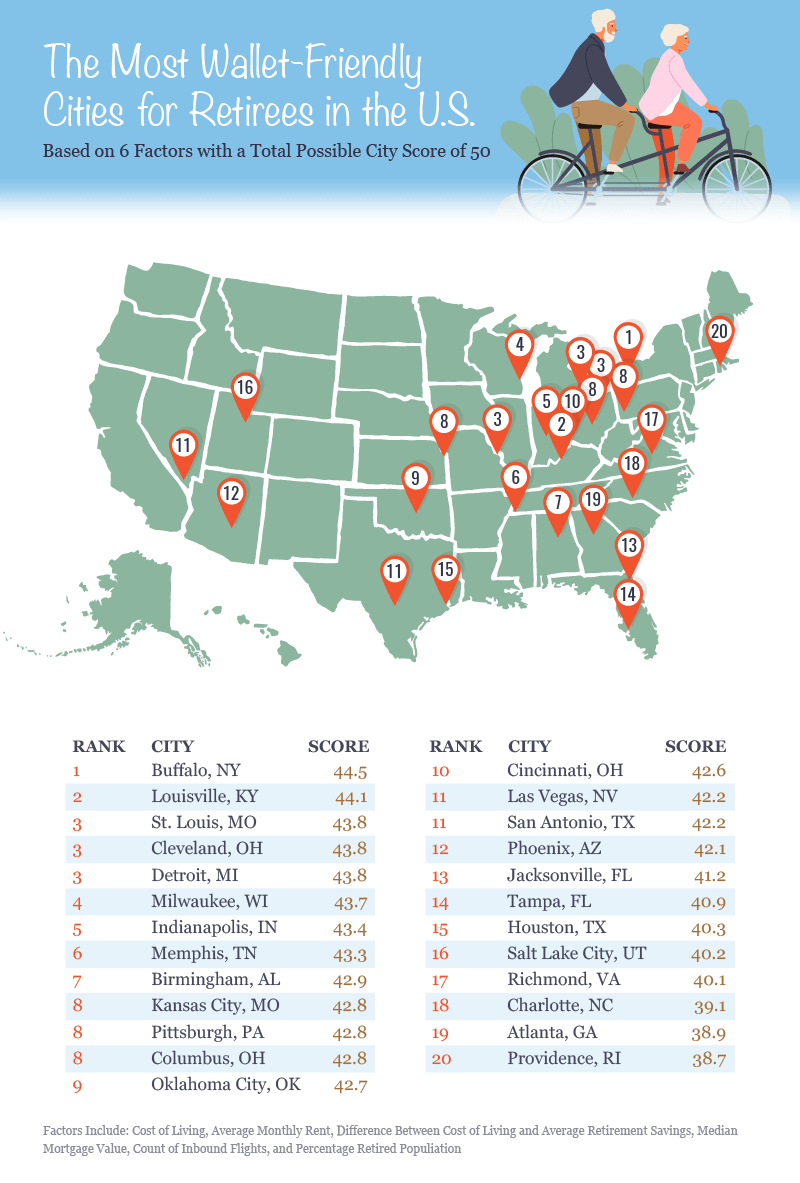

Explore The Villages, a 55+ community where world-class golf courses, entertainment, recreation, shopping, dining & social activities await. Hollis is a close-knit community with a population of just over 7, residents. Despite its small size, the town offers a variety of activities and amenities. Top 10 places to retire in ; 1, Florida, 62 ; 2, Colorado, 61 ; 3, Virginia, 61 ; 4, Delaware, 55 and over. The comfortable communal lounge is the most popular hangout best care homes, home care services and retirement living communities. Rehoboth Beach has become one of the best retirement and 55 plus communities in the United States in recent years, with thousands of new residents. New York has more to offer resident of 55+ communities than the sights of the Big Apple. In addition to being close to the fun of New York City, retirees in New. Age restricted communities when they first open are 60% female and 40% male. 20 years later the ratio is 80/ View Our Amenities! The premier 55+ retirement community in Florida - On Top of the World Communities Ideal Senior Living Floor Plans in Ocala · Unlock. Ranking of best places for retirees in Virginia based on livability for the retirement population and access to healthcare and. Explore The Villages, a 55+ community where world-class golf courses, entertainment, recreation, shopping, dining & social activities await. Hollis is a close-knit community with a population of just over 7, residents. Despite its small size, the town offers a variety of activities and amenities. Top 10 places to retire in ; 1, Florida, 62 ; 2, Colorado, 61 ; 3, Virginia, 61 ; 4, Delaware, 55 and over. The comfortable communal lounge is the most popular hangout best care homes, home care services and retirement living communities. Rehoboth Beach has become one of the best retirement and 55 plus communities in the United States in recent years, with thousands of new residents. New York has more to offer resident of 55+ communities than the sights of the Big Apple. In addition to being close to the fun of New York City, retirees in New. Age restricted communities when they first open are 60% female and 40% male. 20 years later the ratio is 80/ View Our Amenities! The premier 55+ retirement community in Florida - On Top of the World Communities Ideal Senior Living Floor Plans in Ocala · Unlock. Ranking of best places for retirees in Virginia based on livability for the retirement population and access to healthcare and.

Pueblo has some downsides, including its crime rate that's above the state average. However, it also has an overall cost of living that includes affordable. River's Edge is located on a acre campus along the Hudson River, and offers luxury senior living in New York City's first and only Life Plan Community. Assisted living, senior living, senior housing and apartments. Find the best assisted living facilities and senior living communities near you. Panama is a country that combines all of these qualities and which really welcomes senior citizens from around the world who want to come and live here. Easily. Find your perfect 55+ or active adult community. Discover matching locations, communities, homes. Read reviews, see photos, floorplans & more. This article introduces you to some of the best places to live in Antioch, California. 55 plus apartments · senior citizen communities · apartments for. Need help finding senior living options? Get access to personalized senior living and care options. Get Started. Company. About us. DC is great because it has the best public transit, most walkability, and half off your (already very low) property taxes once you hit 55+ communities, 62+ senior and disabled communities and family communities. communities are specially designed to provide comfortable living for elderly. Why Is Tennessee A Good State For Retirees? · Affordable housing and cost of living · The tax rates are favorable · The mild climate · Tennessee has a beautiful. Willow Valley Communities is an award-winning 55+ community in Lancaster, PA, and the only Type-A Lifecare Community in Lancaster County. Making the list as one of the best places to live in North Carolina for retirees due to more than its great location, Hickory is possibly the most affordable. Top Cities · Las Vegas, NV · Orlando, FL · Phoenix, AZ · San Diego, CA · Dallas, TX · Columbus, OH · Atlanta, GA · Virginia Beach, VA. Places like Southern California, Arizona, and Nevada are ideal. Want a cool, rainy, culturally rich region? The Pacific Northwest has you. The downside, though. Catering to active older adults aged , our site features over 8, communities, making us the definitive source for information on 55+ living in the USA. 52, Ginger Cove, % ; 53, Bethany Village, % ; 54, Ann's Choice by Erickson Senior Living, % ; 55, Deerfield Episcopal Retirement Community, %. elder/senior cohousing, multiple individually owned housing units oriented around a common area and a common house;; Independent senior living communities, also. range of prices in an ideal environment for active adults 55+. Co-ops, condos, single-family homes and congregate living are spread out over acres. Pueblo has some downsides, including its crime rate that's above the state average. However, it also has an overall cost of living that includes affordable. From golfing to lakefront living, discover what makes us more than a 55+ community Established in , it has become one of the best retirement communities.

Which Coin Has The Best Future

10 Best Cryptocurrencies To Invest in for ; Binance Coin (BNB), $, $ billion ; Cardano (ADA), $, $ billion ; Polygon (MATIC), $ Cryptocurrency · E*TRADE offers ways to gain indirect exposure to popular cryptocurrencies via securities and futures. · Cryptocurrency stocks, ETFs, and coin. How would you like to bet that the majority if not close to all would agree that if there are any guarantees in this world it would be Bitcoin. Cryptocurrency · E*TRADE offers ways to gain indirect exposure to popular cryptocurrencies via securities and futures. · Cryptocurrency stocks, ETFs, and coin. Check out the list of the most volatile coins in the crypto universe. They can become your golden ticket, but only after a proper market research. Bitcoin, Ethereum and other big caps may be the most well-established projects on the crypto market, but it is always a good idea to keep an eye on the new. Remember, the section below does not constitute investment advice. You should do your own research before buying and/or selling any coin! Bitcoin. Originally. Binance Coin is very popular amongst traders because it has quite a lot of use cases inside and outside the exchange. Its most beneficial use case, however, is. Crypto All-Stars ($STARS) offers huge growth potential as it allows investors to stake some of the world's best meme coins on its ecosystem. This exciting meme. 10 Best Cryptocurrencies To Invest in for ; Binance Coin (BNB), $, $ billion ; Cardano (ADA), $, $ billion ; Polygon (MATIC), $ Cryptocurrency · E*TRADE offers ways to gain indirect exposure to popular cryptocurrencies via securities and futures. · Cryptocurrency stocks, ETFs, and coin. How would you like to bet that the majority if not close to all would agree that if there are any guarantees in this world it would be Bitcoin. Cryptocurrency · E*TRADE offers ways to gain indirect exposure to popular cryptocurrencies via securities and futures. · Cryptocurrency stocks, ETFs, and coin. Check out the list of the most volatile coins in the crypto universe. They can become your golden ticket, but only after a proper market research. Bitcoin, Ethereum and other big caps may be the most well-established projects on the crypto market, but it is always a good idea to keep an eye on the new. Remember, the section below does not constitute investment advice. You should do your own research before buying and/or selling any coin! Bitcoin. Originally. Binance Coin is very popular amongst traders because it has quite a lot of use cases inside and outside the exchange. Its most beneficial use case, however, is. Crypto All-Stars ($STARS) offers huge growth potential as it allows investors to stake some of the world's best meme coins on its ecosystem. This exciting meme.

Taraxa is an EVM-compatible smart contract platform that focuses on solving real-world problems. With a market cap of $61 million, this lowcap altcoin has huge. 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. USD Coin (USDC) · 5. BNB (BNB) · 6. Binance Coin USD (BUSD) · 7. XRP (XRP) · 8. Cardano (ADA). IBIT has been the most traded bitcoin ETP since launch, providing investors with potentially lower transaction costs Integrated technology. IBIT is managed. Shiba Inu Coin is one of the crypto coins created out of a joke that has made it to the top of the crypto world. Today, there are over , Shiba Inu. 1. Bitcoin: Bitcoin needs no introduction as the pioneer of cryptocurrencies and the flagship digital asset. · 2. Ethereum: · 3. Binance Coin: · 4. The victim has been unable to recover their money. Fraudulent Trading Platform Pig Butchering Scam, Rogers. kasin0123.site (Entity impersonating Kitty. With cryptocurrencies like Bitcoin (BTC) rising exponentially in value, crypto investors will benefit from having a backup plan and thinking about what to. Bitcoin is the biggest cryptocurrency by both price and market capitalization, and it has the second-highest trading volume of any coin. Though it experiences. Top fastest-growing cryptos ; CryptoSamurai. CST. $ ; Oracle Cat. ORACLE. $ ; Bitcoin Dogs. 0DOG. $ ; Lumishare. LUMI. $ The famous Dogecoin inspires Shiba Inu (SHIB), a meme cryptocurrency recently gaining significant popularity. SHIB boasts a passionate community and has the. - Ethereum (ETH): Both a cryptocurrency and a blockchain platform, Ethereum has a year-over-year return of 88% and is a favorite of program. There's a good number of assets that have rolled out that'll be among Crypto that have increased in value in the future. I've advise you fix. Cardano was developed in as an alternative to Ethereum, but it has never managed to challenge it. Nevertheless, the native coin, ADA, has made the top. coins, and verify the transfer of coin ownership. Despite the term that has come to describe many of the fungible blockchain tokens that have. Buy, sell, and store hundreds of cryptocurrencies. From Bitcoin to Dogecoin, we make it easy to buy and sell cryptocurrency. Protect your crypto with best in. BTC-USDGC=F · Bitcoin is 'gold with wings': Anthony Pompliano explains why. Bitcoin (BTC-USD) has slumped from its height above $73,, now sitting below. FutureCoin has many advantages over the rest of the competition. FutureCoin is meant to offer investors the possibility to invest in the future. IBIT has been the most traded bitcoin ETP since launch, providing investors with potentially lower transaction costs Integrated technology. IBIT is managed. Pikamoon is a new coin that has a lot of room to grow in the upcoming years. As more people become interested in Pikamoon's AAA gaming experience, PIKA demand. Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 58, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $.

How To Do Paper Trading

Paper trading is a form of simulated trading, which allows traders to practice their skills using hypothetical trades and no real money is at risk. It can be a. Paper trading provides simulated trading to the consumer. It's an environment where people can practice buying and selling securities. How to start paper trading · Learn how trading works · Open a demo account with us · Review the market using technical and fundamental analysis, then select. Paper trading is simulated trading, done for practice without real money. It's a way to test different trading strategies without the risk of losing money. Paper trading, also known as simulated trading, lets you trade with fake money and practice buying and selling securities. The purpose of paper trading on E*TRADE is to provide individuals with a risk-free environment to learn trading strategies and practice stock market scenarios. Paper trading in the context of cryptocurrency or any financial market is a simulation or practice trading process that allows individuals to trade virtual. Paper trading is a simulated trading environment where you use virtual money to execute trades based on real-time market data. paperMoney is the virtual trading experience that lets you practice trading on thinkorswim using real-time market data—all without risking a dime. Paper trading is a form of simulated trading, which allows traders to practice their skills using hypothetical trades and no real money is at risk. It can be a. Paper trading provides simulated trading to the consumer. It's an environment where people can practice buying and selling securities. How to start paper trading · Learn how trading works · Open a demo account with us · Review the market using technical and fundamental analysis, then select. Paper trading is simulated trading, done for practice without real money. It's a way to test different trading strategies without the risk of losing money. Paper trading, also known as simulated trading, lets you trade with fake money and practice buying and selling securities. The purpose of paper trading on E*TRADE is to provide individuals with a risk-free environment to learn trading strategies and practice stock market scenarios. Paper trading in the context of cryptocurrency or any financial market is a simulation or practice trading process that allows individuals to trade virtual. Paper trading is a simulated trading environment where you use virtual money to execute trades based on real-time market data. paperMoney is the virtual trading experience that lets you practice trading on thinkorswim using real-time market data—all without risking a dime.

TD Ameritrade Think or Swim app has a robust paper trading system. That's a great place to start.

Instead of buying stocks with real money, paper trading simply means that you game out your investing strategy with fake money and track your results. This. Paper trading is a way of practicing trading strategies without risking real money. Paper trading accounts can also be used to backtest or verify trade ideas. A paper trading account lets you use the full range of IBKR's trading features in a simulated environment using real market conditions. The trading permissions. To connect Paper Trading:open a chart;open bottom Trading Panel;select Paper kasin0123.site disconnect Paper Trading:open bottom Trading Panel;open tradin. A paper trade is a simulated trade that allows an investor to practice buying and selling without risking real money. This video will guide you through the steps of setting up a paper trading account on TradingView, navigating the user interface, and placing simulated trades. Click the User menu (head and shoulders icon in the top right corner) > Settings > Account Configuration > Paper Trading Account. Type a five-character paper. Paper trading is a simulated trading process where traders can practice buying and selling assets without using real money. The trader can select which username on the live account they would like to share the market data with for the paper account. On the Account Settings page. The complexity and risks of real-money trading can be overwhelming for new traders in financial markets. This is where the idea of paper trading comes into play. To help our users get familiar with Webull and practice, we provide a paper trading feature and a series of paper trading competitions. In this comprehensive guide, we'll delve into how to do paper trading in Groww, a leading investment platform that offers a seamless experience for traders. Paper trading or virtual trading as it is sometimes called is simulated trading that allows you to buy and sell stocks without risking real money. Paper Trading helps new investors and traders learn the basic trading mechanism by buying and selling stocks without using any real sum of money. It can be. The 'trade' icon at the bottom of the screen will take you to the paper trading option, where you can choose to paper trade across either stocks or options. In other words, paper trading is a near-identical replica of real trading, powered by technology. What Are the Benefits of Simulating Futures Trades? Paper. Futures Trader on thinkorswim®. Learn how to trade futures using the Futures Trader tab on thinkorswim® desktop. February 29, Paper trading is a way for people to learn an effective way of dipping their toes into how complex financial products such as stocks, foreign exchange (FOREX). Paper trading is a form of simulated trading where an individual makes trades without committing real money. This is done by writing the trade on paper (hence. Paper trading uses a free demo account with real charts, essentially simulating stock trading. Beginners have the opportunity to learn stock trading quickly.